The Rapid Urbanization

~60% population of the country will live in cities by 2050.

Rise in the number of nuclear families

50% of all households in India are now nuclear.

Repatriation of NRIs & HNIs

By 2025, NRIs are projected to contribute 20% of India's total real estate investments.

Infrastructure Development

The Government of India has earmarked INR 3 Lakh Cr for infrastructure projects.

Millionaire Boom

India now boasts more than 8 Lakh millionaires. This growing millionaire population is driving increased demand for real estate as a stable and aspirational asset class.

Real Estate for Millionaires

New millionaires drive demand for financial real estate options with easier entry and exit.

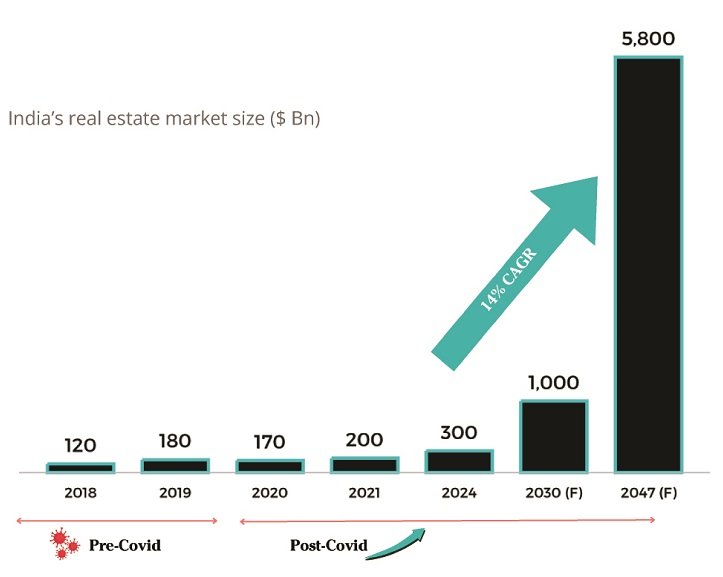

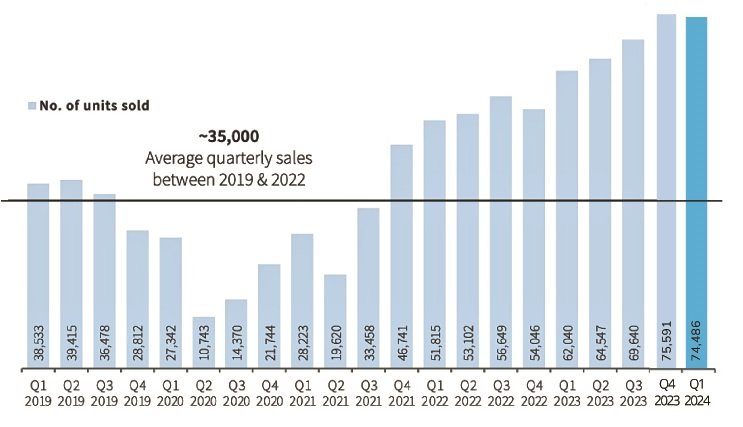

Residential sales set a milestone in Q1 2024, supported by supply from leading developers, favourable economic conditions, and strong buyer confidence.

Residential prices saw strong growth over the past 12 months, defying inflation and rising interest rates, while affordability remained above Pre-COVID levels.

Market velocity and project launches hitting historic highs, driven by shifting buyer behaviour, highlighting the sustained bull run.

Mumbai's booming economy and infrastructure, coupled with its status as India's financial capital,

drive a relentless

demand for real estate.

Mumbai constituted ~ 22% to residential real estate sales in India*

Pune's real estate market is projected to outpace the national average,

growing by 15% in 2025.

Pune constituted ~ 18% to residential real estate sales in India*

7th Floor, B 707, Kohinoor Square, N C. Kelkar Rd, opp. Shiv Sena Bhavan, Dadar-W, Mumbai, Maharashtra. 400028

© 2025 Infradawn Capital. All rights reserved.